Infra Play #118: Woof, woof

Datadog was widely considered as the poster child of the 2021 SaaS top. Does this still hold true in 2025?

Datadog is one of the most well-known cloud infrastructure companies in the industry and synonymous with observability, the industry term we use for the tools and strategies we deploy to understand and analyze the internal state of a complex system. Typically this is done by examining the external outputs of systems, such as logs, metrics, and traces.

In a more simplistic way, complex distributed IT systems break and when they do, they wreak havoc across the world. Observability tools have become critical in solving those outages, either by preventing them entirely through automation or facilitating what the industry calls root cause analysis, the process of investigating and finding the reason why the system broke in the first place.

Today, Datadog remains predominantly the leading observability player (save for their “cloud platform” ambition), but it’s also the one with the most conflicting reputation, both amongst developers and its own employees. Let’s explore why that is and what the future holds for the company.

The key takeaway

For tech sales and industry operators: Datadog has a lot of the fundamentals in place to allow for a successful career (strong brand recognition, customer oriented product experience, and a platform play that solves genuine challenges that impact the bottom line of customers). The trick is that the leadership doesn’t care about you or what a “good outcome” looks like for you. As such, you need to approach the opportunity with a cold and calculated point of view. Will you be able to build transferable skills, expand your customer relationships in your territory, and have a reasonable chance at hitting a “cloud whale” customer? Or are you just a replaceable variable in someone else’s optimization equation that’s funding the company’s platform ambitions with your unrealized commission? If you decide to pursue the opportunity, my advice is to focus on observability and digital experiences that have the strongest product market fit, but be prepared for a prolonged pain curve. I think that the long term value of understanding reliability and resilience of cloud infrastructure (and the potential to strike gold at the right account) is worth the price of admission.

For investors and founders: Datadog achieved a genuine monopoly in observability for high growth cloud companies, then immediately began competing in crowded markets instead of defending and deepening their core advantage. This is classic innovator’s dilemma behavior: sacrificing definite optimism (dominating observability) for indefinite optimism (being a “platform”). It’s easy to see an alternative timeline where instead of trying to shift left, the company had focused on expanding significantly its observability market share by offering the strongest product on the market at similar or cheaper price levels as the alternatives. This tool consolidation opportunity was wasted, to the benefit of companies like Dynatrace and Grafana, while the sales teams that got them here were essentially forced to churn due to an intentionally low compensation strategy. Despite these missteps, the company has been able to execute well in its “sweet spot” and has become widely adopted amongst the AI-native companies launching today. The tradeoff has been introducing significant product complexity, an extractive pricing model that has significantly impacted the company’s reputation with its existing install base, and a distracting platform play. Credit where it’s due; it’s clear that they are currently able to scale the business on the back of the AI transformation of the industry. Still, the mean reversion risk is not yet accounted for by most analysts, who got caught off guard by the strong earnings beat and will likely flip bias.

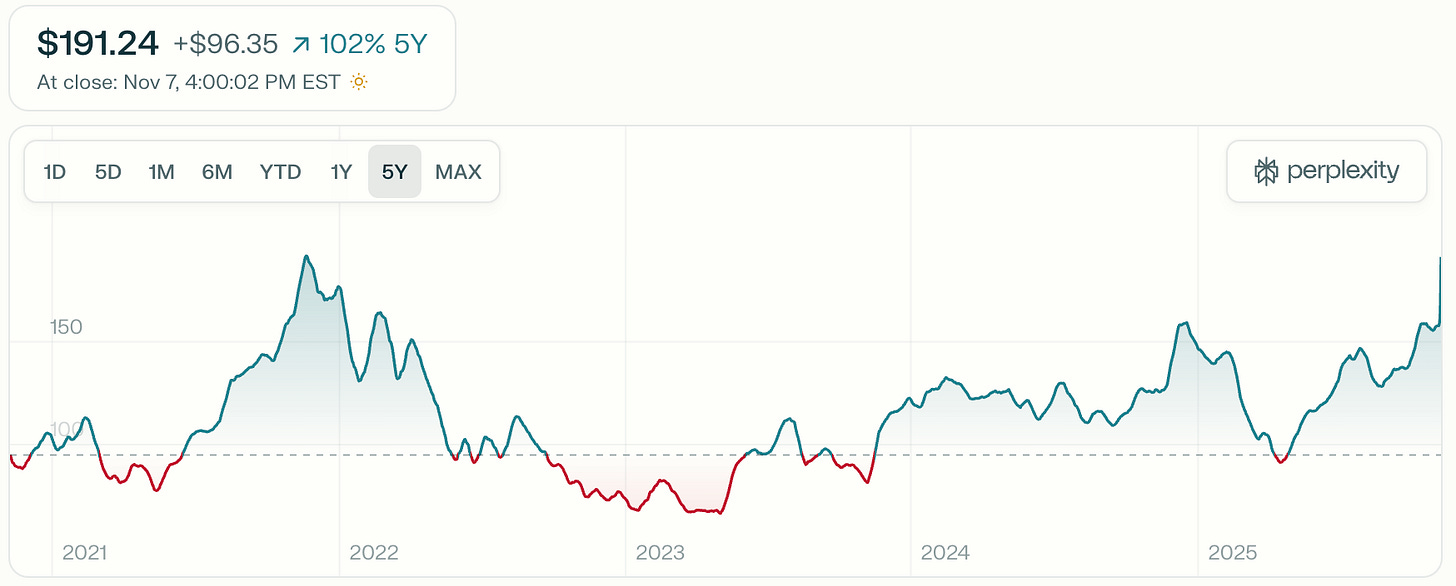

18 months of pain

As part of this deep dive, I’ll start with the vision presented during the last investor day in February 2024 and see where we sit today based on their latest quarterly report. At a high level, Datadog peaked in the market at the top of the SaaS valuations bubble in late 2021 and failed to significantly recover until ChatGPT burst onto the scene and investors realized that if AI adoption happens, it will lift all other parts of cloud infrastructure software. During the investor day, Olivier had to sell the vision of how the company that started by focusing on bridging the gap between developers and operational teams will now lead the market in capturing the need to observe the rising demand for computing.

Keep reading with a 7-day free trial

Subscribe to Infra Play to keep reading this post and get 7 days of free access to the full post archives.